- Up n' Running

- Posts

- 🎵 TikTok’s fate in the US

🎵 TikTok’s fate in the US

PLUS: India holds steady on borrowing

Good morning. Move over, King Kohli - Smriti Mandhana just smashed a 50-ball century, breaking his record for India’s fastest ODI ton.

Queen things 👑 🏏

Ruchirr Sharma & Shatakshi Sharmaa

TABLE OF CONTENTS

🤑 India holds steady on borrowing, bets on GST 2.0 for growth

Bite-sized summaries

🧑🍳 What else is cookin’?

MARKETS

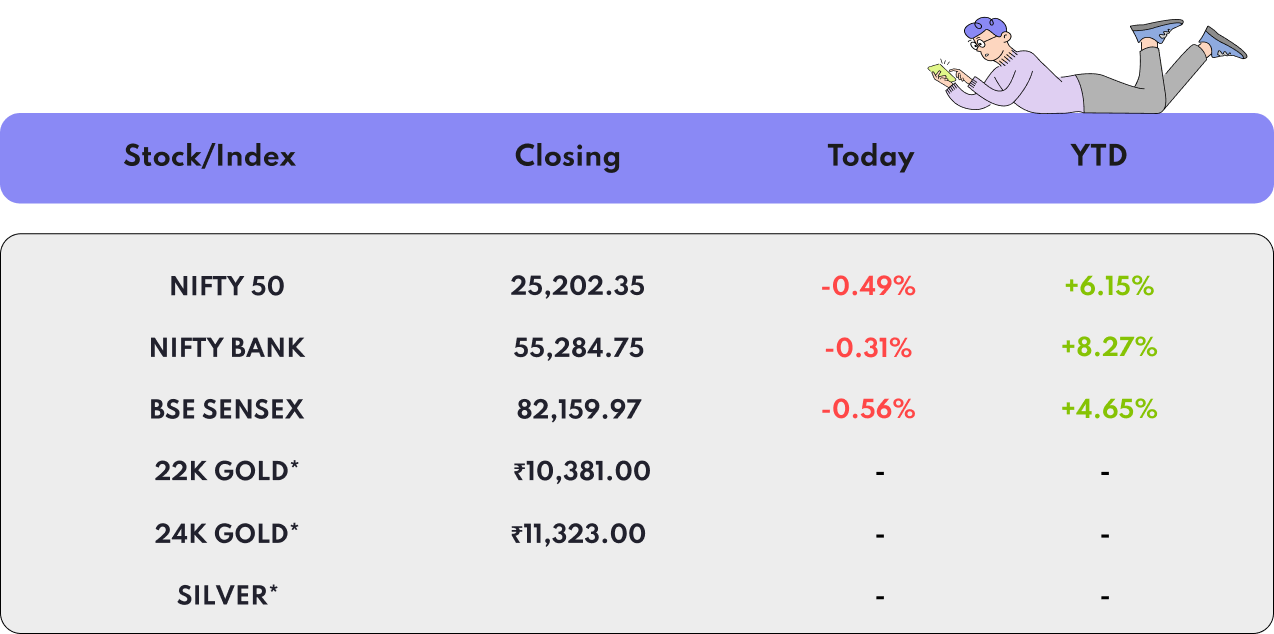

🇮🇳 India

indicates per gram rate in Delhi | Stock data as of market close 22/09/2025

Indian equities fell as IT stocks tumbled nearly 3% following the US government’s announcement of a sharp hike in H-1B visa fees. The sell-off was broad-based, with midcap and smallcap indices also declining. Energy and select Adani Group stocks bucked the negative trend, but widespread profit-booking followed recent gains. Volatility, as measured by India VIX, spiked nearly 6%.

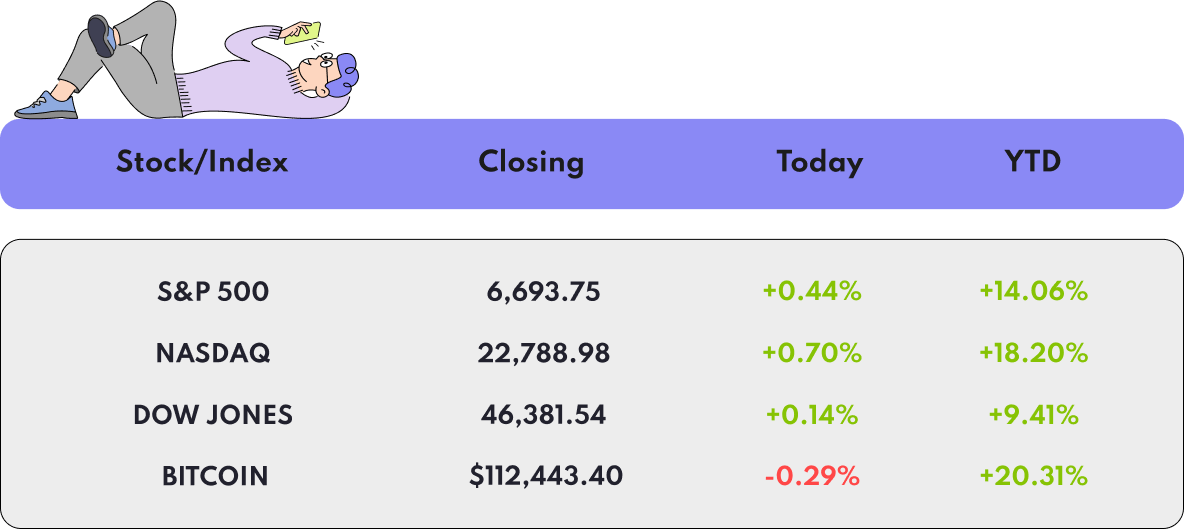

🌍️ International

Stock data as of market close 22/09/2025

US stocks closed at record highs for a third straight session, with all major indices rising modestly. Nvidia surged nearly 4% on news of a major OpenAI partnership, and Apple rallied 4% on strong iPhone demand. Investors largely shrugged off mixed signals from Fed officials, as optimism over AI and tech earnings continued to drive gains.

TIKTOK

The TikTok drama in America is entering what looks like its final act. According to The Wall Street Journal, President Trump is expected to sign an executive order this week approving a deal that would keep the app alive for its 170 million U.S. users.

The deal in the works:

TikTok’s U.S. assets would shift from Chinese parent ByteDance to a group of American investors, including Larry Ellison (Oracle), Michael Dell, and media mogul Lachlan Murdoch.

The new entity would be overseen by a U.S.-based board with cybersecurity and national security expertise.

This setup is meant to meet Washington’s concerns that TikTok could be used by Beijing to access American user data.

Why it matters:

For years, TikTok has lived under the shadow of bans and forced-sale threats. Back in 2020, Trump tried a similar move but the effort stalled. Since then, both Republican and Democratic administrations have kept pressure on the company.

If approved, this deal would mark the first time a major Chinese tech platform is effectively reshaped under U.S. control. For users, TikTok would remain on their phones; for policymakers, it’s about proving they can rein in Chinese tech influence.

The bigger picture: Beyond dance challenges and memes, TikTok has become a geopolitical chess piece. The U.S. wants to set a precedent: if you want access to its digital market, you play by its rules.

Read more: Economic Times

BORROWING

India is keeping its borrowing plans unchanged for the second half of FY26, signaling confidence in both fiscal discipline and economic momentum.

Key numbers:

Market borrowing (H2 FY26): ₹6.82 lakh crore (unchanged).

Gross market borrowing for FY26: ₹14.82 lakh crore.

Fiscal deficit target: 4.4% of GDP (down from 4.8% in FY25).

Absolute deficit: pegged at ₹15.69 lakh crore.

Net market borrowings from dated securities: ₹11.54 lakh crore.

Chief Economic Adviser V Anantha Nageswaran said the government is confident about staying on course, pointing to GST 2.0 reforms as a major growth driver.

Why GST 2.0 matters:

Came into effect this week.

Expected to boost domestic demand through lower indirect taxes.

Combined with recent income tax reliefs, the total stimulus could inject ₹2.5 lakh crore+ into the economy.

Nageswaran projects a multiplier effect of over ₹2 for every ₹1 spent.

Growth outlook:

GDP growth for FY26 is forecast to land at the upper end of 6.3–6.8%.

The Economic Survey had earlier set the same range.

Overall: By holding borrowing steady while banking on tax reforms, India is signaling that it can both manage its fiscal books and spur growth. The balancing act will be tested by uncertainties—like global oil prices and external demand—but for now, the government is betting on reform-led momentum rather than fresh debt.

Read more: Economic Times

GENERAL OVERVIEW

🗞️ Bite-sized summaries

🇺🇸 Visa Shock, India Gain - Donald Trump’s decision to impose a $100,000 fee on new H-1B visas is reshaping Wall Street’s hiring strategies. Banks like Citigroup, JPMorgan, and Goldman Sachs, already big employers in India, are expected to expand their Global Capability Centers (GCCs) in hubs such as Mumbai and Bengaluru. These centers handle technology, risk, and compliance at scale, offering global firms access to talent at lower costs. With India’s GCC sector already worth $64 billion and projected to hit $110 billion by 2030, analysts see the policy accelerating India’s role as a global banking and technology hub.

🩺 Doctors may be spared - The Trump administration’s new $100,000 H-1B visa fee could exempt certain professionals, including physicians and medical residents, a White House spokesperson confirmed. While the policy aims to filter out lower-paid workers and raise over $100 billion for the U.S. Treasury, it has sparked concern among international professionals, particularly from India, which accounts for 71% of H-1B holders. The fee threatens India’s $250 billion IT industry, long reliant on U.S. placements. Exemptions for doctors may ease worries in healthcare, but uncertainty looms for tech workers and firms facing soaring costs, dampened stock prices, and fears of reduced global mobility.

HEADLINES

🧑🍳 What else is cookin’?

What’s happening in India (and around the world 🌍️)

Jimmy Kimmel show to return after suspension over Charlie Kirk comments.

Queues at car dealers, online carts piled high on day 1 of GST 2.0 launch.

ONGC directed to take charge of Vedanta oil block.

Doctors may be exempt from $100,000 H-1B visa fee.

You’re the best :)

It would mean the world to us if you shared this link with a friend!

P.S.: Up n’ Running can now be installed as an app on your phone! Here’s how:

Click on the banner above and select your browser of choice.

You will receive a pop-up saying “Install the app.”

Follow the instructions on that pop-up, and voila - you will now receive Up n’ Running updates directly to your phone! It’s also an easy way for you to access previous Up n’ Running editions at will.

That’s all for today folks - have a lovely day and we’ll see you tomorrow.