- Up n' Running

- Posts

- 💳️ Swipe Now, Worry Later?

💳️ Swipe Now, Worry Later?

PLUS: Fewer missed shots, but still a long way to go

Good morning. It’s going to be a great day - let’s go after it 🍞 💪

Ruchirr Sharma & Shatakshi Sharmaa

TABLE OF CONTENTS

💳️ Swipe Now, Worry Later?

Bite-sized summaries

🧑🍳 What else is cookin’?

MARKETS

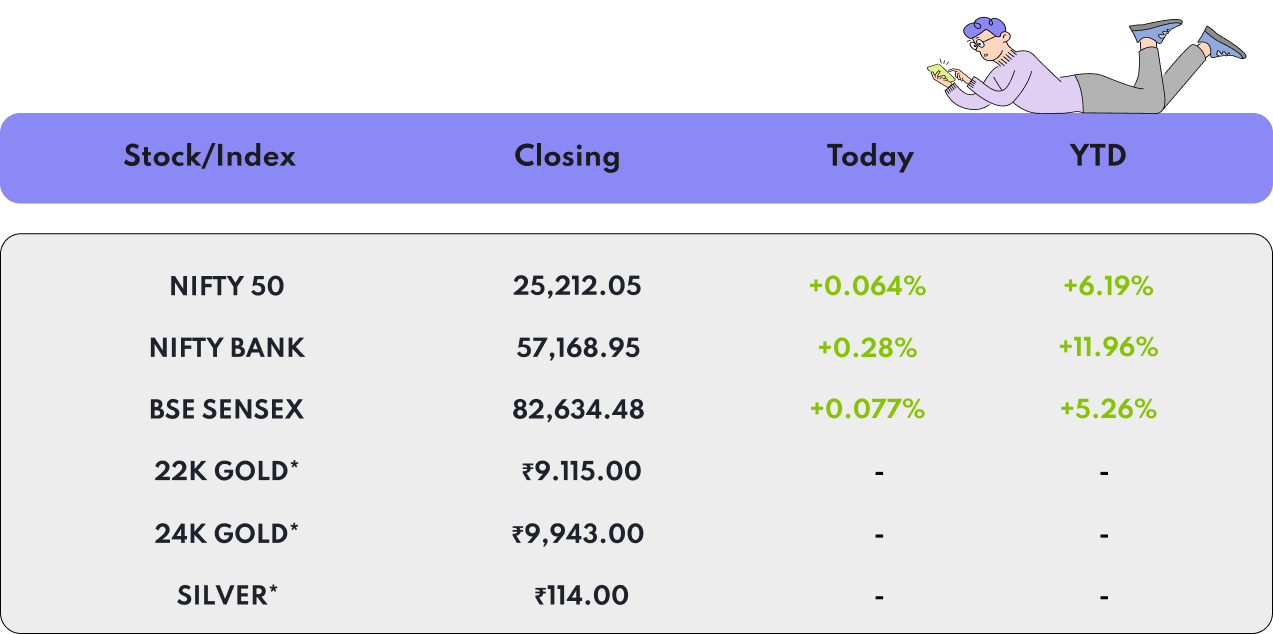

🇮🇳 India

indicates per gram rate in Delhi | Stock data as of market close 16/06/2025

The Indian stock market closed higher, led by gains in IT, banking, and auto stocks. Benchmarks advanced as investor sentiment improved on favorable inflation data and early optimism in earnings season. Broader markets also gained, while foreign inflows provided support. Overall mood was upbeat despite lingering global uncertainties and cautious outlook on policy cues.

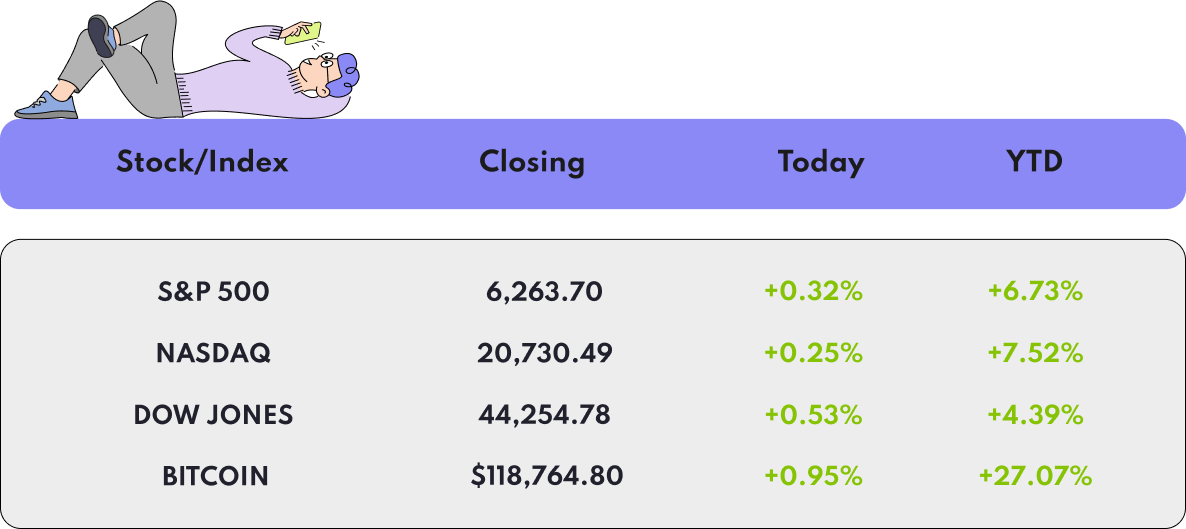

🌍️ International

Stock data as of market close 16/06/2025

US markets closed higher, driven by strong corporate earnings and a rebound in technology shares. Investor optimism was boosted by better-than-expected results and easing bond yields, though caution persisted due to ongoing global economic and geopolitical tensions.

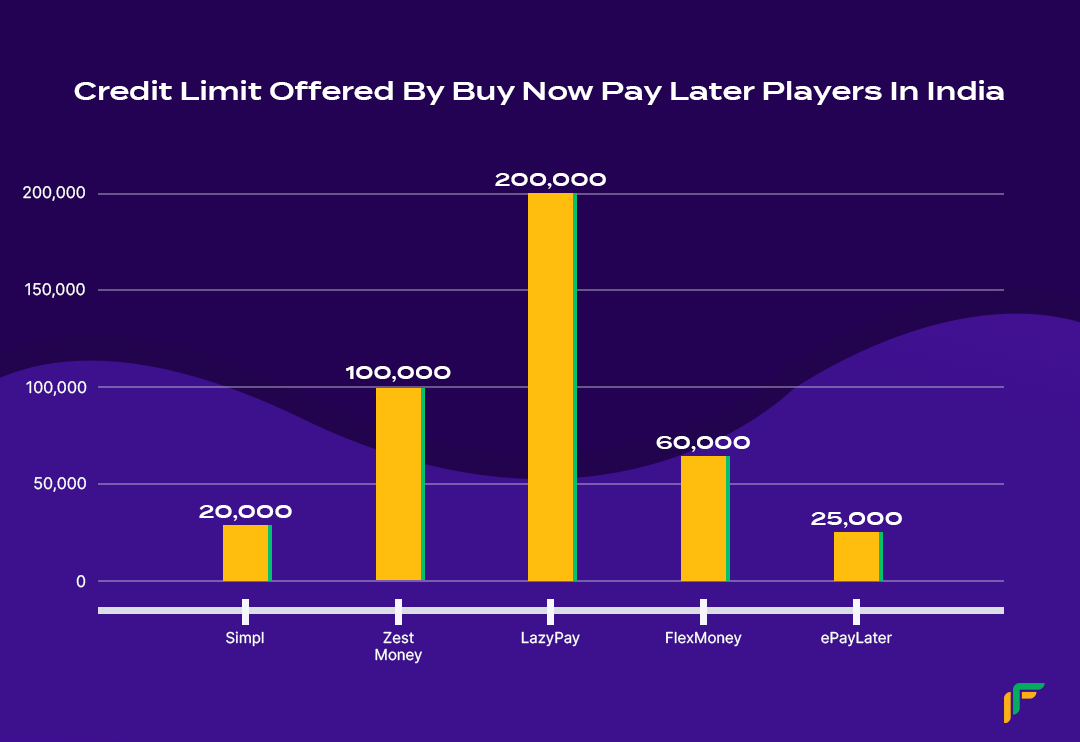

BNPL

Source: Cashfree Payments

In India’s evolving financial landscape, plastic is no longer a luxury - it’s a lifeline.

A new report by Think360.ai reveals that 93% of salaried Indians earning under ₹50,000 per month are now relying on credit cards to make ends meet. Among self-employed workers, that number is 85%.

The message is clear: short-term credit is fast becoming a necessity, not a choice.

And it’s not just cards: Buy Now, Pay Later (BNPL) services are picking up steam too - used by 15% of salaried workers and 18% of the self-employed, according to the report.

What’s fueling this credit boom?

A mix of rising living costs, unpredictable cash flow, and the digital ease of tapping into credit.

Traditional banks often shy away from lower-income or gig workers—leaving a void that fintech firms are rushing to fill.

In FY23 alone, fintechs disbursed over ₹92,000 crore in personal loans, making up three-fourths of all new loan originations.

What used to be aspirational - having a credit card or flexible EMI plan - is now the norm for India’s middle and lower-income earners. It signals a shift in how financial services are consumed, and how deeply embedded digital credit has become in everyday life.

The broader implication: While credit access has democratized, it’s also walking a tightrope. As more Indians lean on credit to stretch every rupee, ensuring responsible borrowing and financial literacy will be key to avoiding a debt trap.

Read more: Economic Times

GENERAL OVERVIEW

🗞️ Bite-sized summaries

Source: Gado via Getty Images

☕ Scale AI trims workforce after Meta infusion - Scale AI, a key player in AI data labeling, is cutting 200 full‑time roles (~14%) and ending contracts with 500 contractors just weeks after Meta poured around $14.3 billion for a 49% stake and lured away founder Alexandr Wang. Interim CEO Jason Droege says the company “ramped up our GenAI capacity too quickly,” creating layers of bureaucracy and inefficiency, prompting a restructuring of its GenAI teams into five strategic pods. Major clients like Google and OpenAI scaled back work post‑Meta deal, fueling the pivot. Scale plans to reinvest in enterprise, public‑sector, and international markets later in 2025, while streamlining go‑to‑market efforts. Affected staff will receive severance, and the company maintains it’s still well‑funded.

💵 OpenAI adds in‑ChatGPT checkout to boost revenue - OpenAI is cooking up a new e‑commerce feature inside ChatGPT: an embedded payment checkout system that could directly process purchases and score commissions on every sale. The feature is being developed in partnership with Shopify, and early demos are already in front of brands. Until now, ChatGPT merely showcased products and linked users to third‑party retailers. With the new checkout functionality, OpenAI can monetize free‑tier traffic by taking a cut from merchants. It’s a strategic pivot beyond subscriptions, tapping into the $10 billion run‑rate the company hit in June. The move is seen as a direct challenge to traditional search ad revenue especially Google’s as digital shopping shifts into AI chat. The feature’s still in development, and terms are being worked out.

HEADLINES

🧑🍳 What else is cookin’?

What’s happening in India (and around the world 🌍️)

A key governing partner of Netanyahu is quitting, leaving him with minority in Israeli parliament.

Free AI training to 5.5 lakh village entrepreneurs soon, says Ashwini Vaishnaw.

RBI's commitment to keep sufficient liquidity will facilitate rate cut transmission: Fitch.

CULTURE

🍿 Entertainment, Entertainment, Entertainment

Source: The Hindu

Sardaar Ji 3 global box office report: Diljit Dosanjh's film earns more than Rs 55 Crore without India release.

Women’s Cricket: England beaten by India in first ODI by 4 wickets.

You’re the best :)

It would mean the world to us if you shared this link with a friend!

P.S.: Up n’ Running can now be installed as an app on your phone! Here’s how:

Click on the banner above and select your browser of choice.

You will receive a pop-up saying “Install the app.”

Follow the instructions on that pop-up, and voila - you will now receive Up n’ Running updates directly to your phone! It’s also an easy way for you to access previous Up n’ Running editions at will.

That’s all for today folks - have a lovely day and we’ll see you tomorrow.