- Up n' Running

- Posts

- 🚀 India’s FDI pops off

🚀 India’s FDI pops off

PLUS: Amazon’s AI truth bomb

Good morning and happy Friday. Have a great chill weekend when it arrives 🌞

Ruchirr Sharma & Shatakshi Sharmaa

TABLE OF CONTENTS

🗞️ Bite-sized summaries

🧑🍳 What else is cookin’?

MARKETS

🇮🇳 India

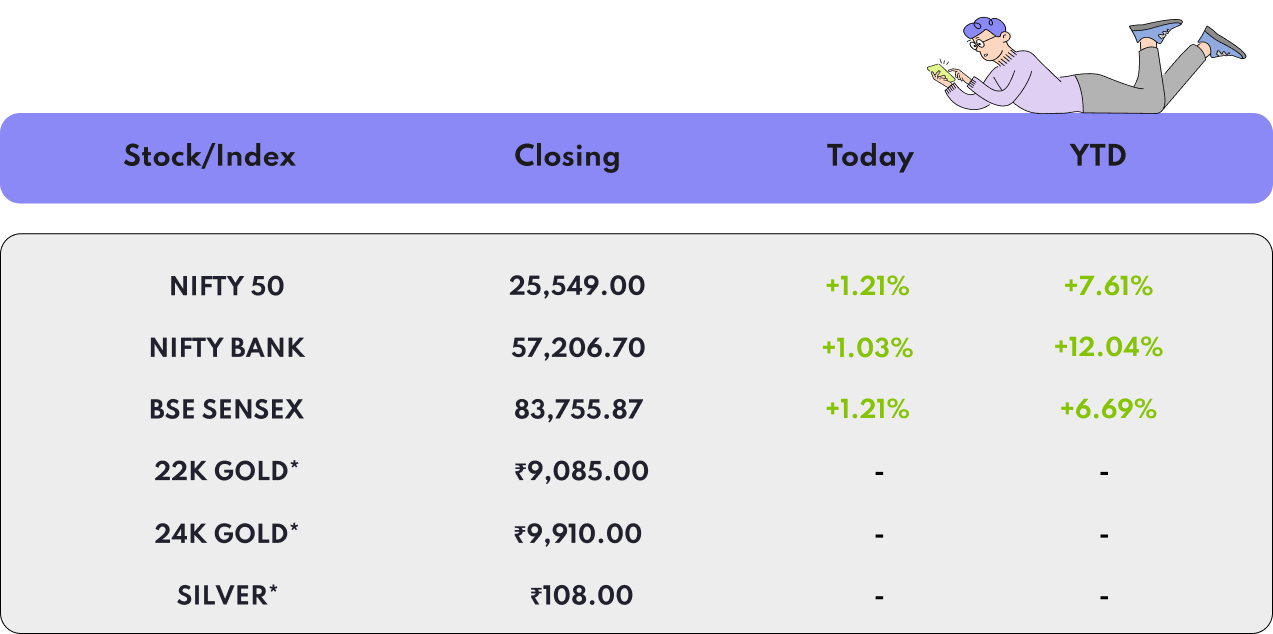

indicates per gram rate in Delhi | Stock data as of market close 26/06/2025

Indian stock markets traded rangebound with investors adopting a wait-and-watch approach amid mixed global cues. Major indices showed little movement as participants assessed upcoming economic data and central bank signals. Sectoral performance was mixed, and overall sentiment stayed neutral, reflecting uncertainty about the near-term market direction.

MARKETS

Source: Z News

India just bagged a serious confidence boost from global investors. Foreign Direct Investment (FDI) inflows surged to $8.8 billion in April, marking a 22–23% jump year-over-year and the highest monthly tally in over three years. For context, April 2024 saw $7.2 billion and March 2025 clocked in at $5.9 billion.

What’s behind the spike? A solid mix of manufacturing muscle and business services boom, which together made up nearly half the inflow. Global firms are opening their wallets and India is reaping the rewards: it now ranks #16 worldwide in FDI inflows, with its digital economy alone pulling in a hefty $114 billion in greenfield investments from 2020 to 2024 - more than any other Global South economy.

With all that foreign capital pouring in, the Reserve Bank of India isn’t complaining. FDI is helping shore up foreign exchange reserves and keep the rupee from getting too rowdy. On top of that, foreign portfolio investors (FPIs) added another $1.7 billion in May, driven by cooling geopolitical tensions, solid earnings, and a friendlier global outlook. That’s three straight months of gains - good vibes only.

It’s not all sunshine though. Non-Resident Indian (NRI) deposits did rise slightly to $165.4 billion, but the pace is slowing. Whether it’s changing diaspora behavior or tighter liquidity abroad, the growth in NRI deposits isn’t keeping up with past trends.

🧾 Bottom Line: India’s capital inflow story is looking sharp: FDI is booming, the rupee’s behaving, and portfolio investors are back in the mix. Even with NRI deposits cooling off, the overall picture? One of strong global vote of confidence.

Read more: Economic Times

TECH

Source: The Hollywood Reporter

Amazon CEO Andy Jassy has dropped a cold hard truth: AI is coming for jobs. In a memo sent June 17 to roughly 350,000 corporate employees, Jassy warned that generative AI and “AI agents” will soon boost efficiency to the point that fewer people will be needed in current roles. Over the next few years, that’s expected to mean a smaller corporate workforce.

It’s not just talk. Amazon is actively building over 1,000 generative AI tools, covering everything from warehouse operations to chatbots and coding assistance.

And the investment’s massive - part of an annual capex spree, including $100+ billion funnelled into AI and infrastructure .

The memo sparked an internal uproar. In Slack channels, staff voiced frustration - one quipped sarcastically that there’s “nothing more motivating on a Tuesday than… your job being replaced by AI.” Others warned it could harm employee morale and derail customer-focus.

Amazon isn’t alone. Companies like Shopify and Duolingo are demanding teams justify why a human job can’t be handed to AI with entry-level help roles feeling most at risk across the industry.

Overall: Amazon’s AI pivot is bold, unavoidable, and starkly unfiltered. The message to its workforce? Upskill — or risk the bots winning first. Adaptation just went from smart to survival strategy.

Read more: Economic Times

GENERAL OVERVIEW

🗞️ Bite-sized summaries

Source: The Guardian

🇺🇸 Tariff deadline may shift - The White House has hinted that the July 9 deadline for implementing higher reciprocal tariffs could be extended, offering breathing room for countries still negotiating trade deals with the U.S. While the UK has finalized an agreement and China reached a temporary truce, most partners are still in talks. Press Secretary Karoline Leavitt emphasized the date isn’t fixed, and President Trump could impose tariffs later if needed. Treasury Secretary Bessent added that extensions are “highly likely” for countries negotiating in good faith, signaling flexibility as global trade tensions continue to simmer.

🥇 Zohran Mamdani's victory shakes things up - Zohran Mamdani, a 33‑year‑old Indian‑American democratic socialist and New York State Assemblyman, scored a major upset by defeating former Governor Andrew Cuomo in the June 24 Democratic mayoral primary, becoming the presumptive nominee. His platform- rent freezes, free buses, city‑run grocery stores, and tax hikes on the wealthy - resonated with young and working‑class voters, energizing grassroots support. The victory rattled Wall Street: billionaire Bill Ackman pledged to invest hundreds of millions to oppose him, fearing capital flight and economic. Mamdani’s win signals a seismic shift toward progressive politics in NYC, igniting intense debate over the city's future.

HEADLINES

🧑🍳 What else is cookin’?

What’s happening in India (and around the world 🌍️)

Elon Musk's confidant Omead Afshar exits Tesla in latest high-level departure.

Touchdown at ISS; Indian astronaut Shubhanshu Shukla says the view was beyond expectations.

Axiom Space, Skyroot Aerospace ink MoU for space exploration, access to low-earth orbit.

Indian, Chinese defence minister meet for first time since Ladakh deal.

You’re the best :)

It would mean the world to us if you shared this link with a friend!

P.S.: Up n’ Running can now be installed as an app on your phone! Here’s how:

Click on the banner above and select your browser of choice.

You will receive a pop-up saying “Install the app.”

Follow the instructions on that pop-up, and voila - you will now receive Up n’ Running updates directly to your phone! It’s also an easy way for you to access previous Up n’ Running editions at will.

That’s all for today folks - have a lovely day and we’ll see you next week.