- Up n' Running

- Posts

- 🇺🇸 India needs more than America

🇺🇸 India needs more than America

PLUS: UPI tax shock

TABLE OF CONTENTS

Bite-sized summaries

🧑🍳 What else is cookin’?

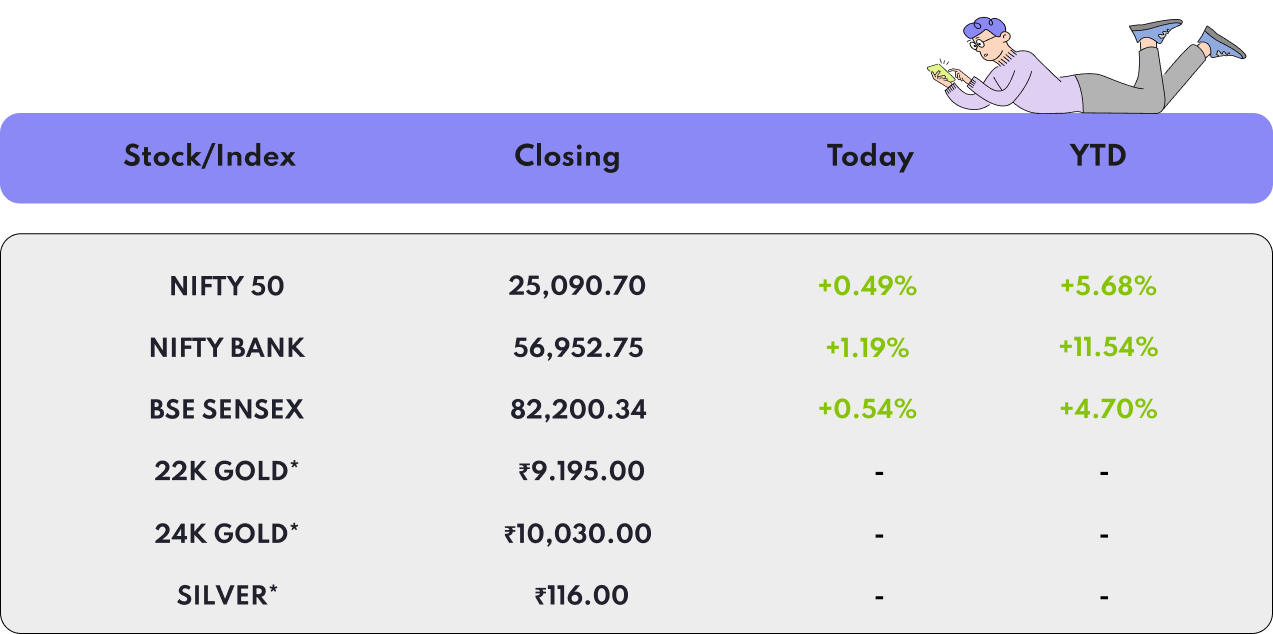

MARKETS

🇮🇳 India

indicates per gram rate in Delhi | Stock data as of market close 21/06/2025

The Indian stock market closed higher, snapping a recent losing streak. Gains in banking and metal stocks led the advance, with ICICI Bank and HDFC Bank driving momentum. Broader indices were mixed as midcaps edged up and smallcaps remained flat. Positive earnings, lower volatility, and resilient financials supported sentiment, even as global trade uncertainty persisted.

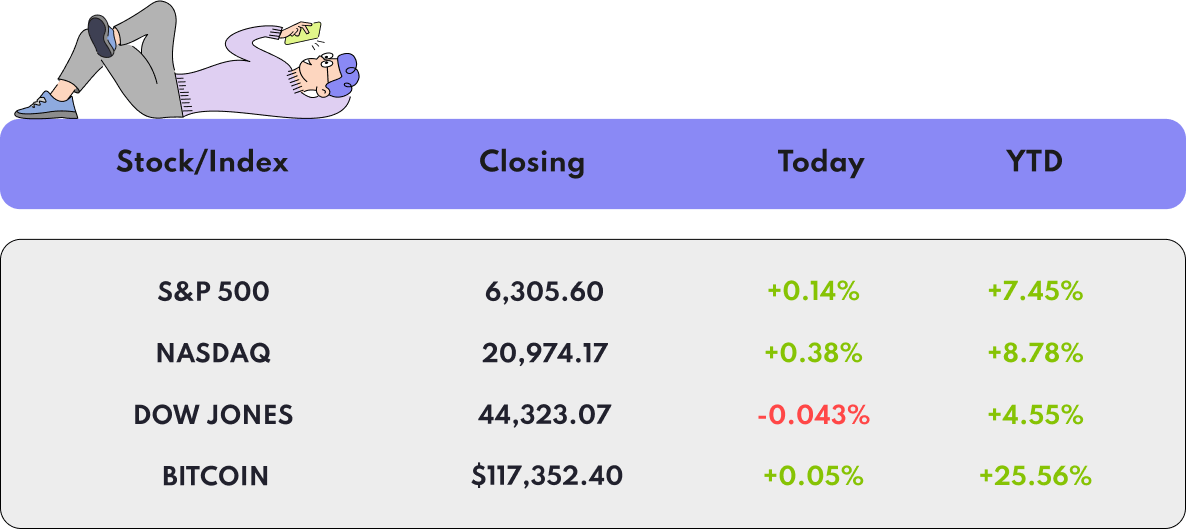

🌍️ International

Stock data as of market close 21/06/2025

US markets hit new record highs, with the S&P 500 and Nasdaq buoyed by strong earnings from technology megacaps and optimism around potential trade agreements. The Dow ended slightly lower. Investor focus was on upcoming earnings reports and the ongoing tariff debate, while corporate profits and resilient consumer spending helped sustain positive momentum.

FOREIGN POLICY

As the US gradually steps back from its role as the world’s economic and security anchor, India faces a strategic dilemma. The Trump-era uncertainty, combined with long-term shifts in American global posture, has made it clear: India can’t bet all its chips on Washington.

Ashok Malik argues that India must stop reacting tactically and start thinking strategically. With the US no longer consistently filling global gaps in trade, tech, and security, no single country or bloc can replace it. Instead, countries like India must build their own webs of economic interdependence to stay relevant in this smash-and-grab global order.

The way forward? Make India indispensable. That means positioning itself as a trade, tech, and supply chain partner to as many nations as possible—be it ASEAN countries, Australia (think rare earths), or even difficult partners like Turkiye. Free trade agreements are not enough. India must offer hard economic value to each nation it engages with.

This is already underway in patches: a pending UK trade deal (hello Scotch), and a pragmatic outreach to the Maldives despite political friction. But these moves must scale.

Without serious economic leverage, India risks being a “vishwa also-ran,” not a global leader. If India wants to matter in a fragmented world, it must be everyone’s economic must-have. That’s the new diplomacy.

Read more: Economic Times

UPI

A storm is brewing in Bengaluru’s markets - and it’s not the monsoon.

Over 14,000 small traders and street vendors have received GST notices demanding back taxes on UPI transactions spanning the last four years. Now, they're pushing back hard.

Starting July 23, vendors across Karnataka will stage a three-day protest.

Milk and milk-based products won’t be sold for two days, and traders will wear black badges.

On July 25, they plan to gather en masse at Freedom Park in Bengaluru for a day-long bandh.

What triggered this?

The GST department has slapped notices on traders selling flowers, milk, vegetables, tender coconuts—essentially, the city’s street economy—claiming they owe lakhs in back taxes based on digital UPI records.

Many merchants were blindsided, saying they were never made aware that digital payments could trigger GST demands.

The protests aren’t about avoiding taxes but about the lack of clarity, awareness, and suddenness of the move. Traders say they’re ready to comply from 2026-27 but can’t shoulder retroactive burdens without due notice or education.

The fallout: Signboards are popping up warning “No UPI accepted, cash only.” Even cab and auto unions are rallying behind the traders, fearing similar treatment.

While Deputy CM D K Shivakumar blames the Centre’s GST Council, the BJP says the state is using these notices to meet revenue targets. Political finger-pointing aside, the ground reality is simple: small vendors feel betrayed by a system that encouraged digital payments - only to tax them retroactively.

Read more: Economic Times

GENERAL OVERVIEW

🗞️ Bite-sized summaries

🤑 India’s debt growth slows - India’s central government debt grew slower than GDP between FY21 and FY23, indicating improved debt sustainability, according to the Comptroller and Auditor General (CAG). After peaking at 61.38% in FY21 due to pandemic-related borrowing, the Centre’s debt-to-GDP ratio eased to 57.93% in FY23. The repayment rate of public debt also improved, with 81.22% of debt repaid versus 89.75% in FY19. This shift frees up more funds for productive expenditure. However, interest payments still consumed over a third of revenue receipts. The CAG also flagged ₹543 crore in financial discrepancies in the railways, including undercharges and excess payments.

HEADLINES

🧑🍳 What else is cookin’?

What’s happening in India (and around the world 🌍️)

Fentanyl terror: there's a Khalistan-China connection.

Vice President Jagdeep Dhankhar resigns 'to prioritise health' as Monsoon Parliament session kicks off.

Apple has a new Indian-American COO, Sabih Khan.

CULTURE

🍿 Entertainment, Entertainment, Entertainment

Saiyaara: All the box office records broken by Ahaan Panday and Aneet Padda's debut film.

‘The Cosby Show’ star Malcolm-Jamal Warner dies from accidental drowning at 54.

IND vs ENG: Playing XI announced! England make one change for Manchester Test

You’re the best :)

It would mean the world to us if you shared this link with a friend!

P.S.: Up n’ Running can now be installed as an app on your phone! Here’s how:

Click on the banner above and select your browser of choice.

You will receive a pop-up saying “Install the app.”

Follow the instructions on that pop-up, and voila - you will now receive Up n’ Running updates directly to your phone! It’s also an easy way for you to access previous Up n’ Running editions at will.

That’s all for today folks - have a lovely day and we’ll see you tomorrow.